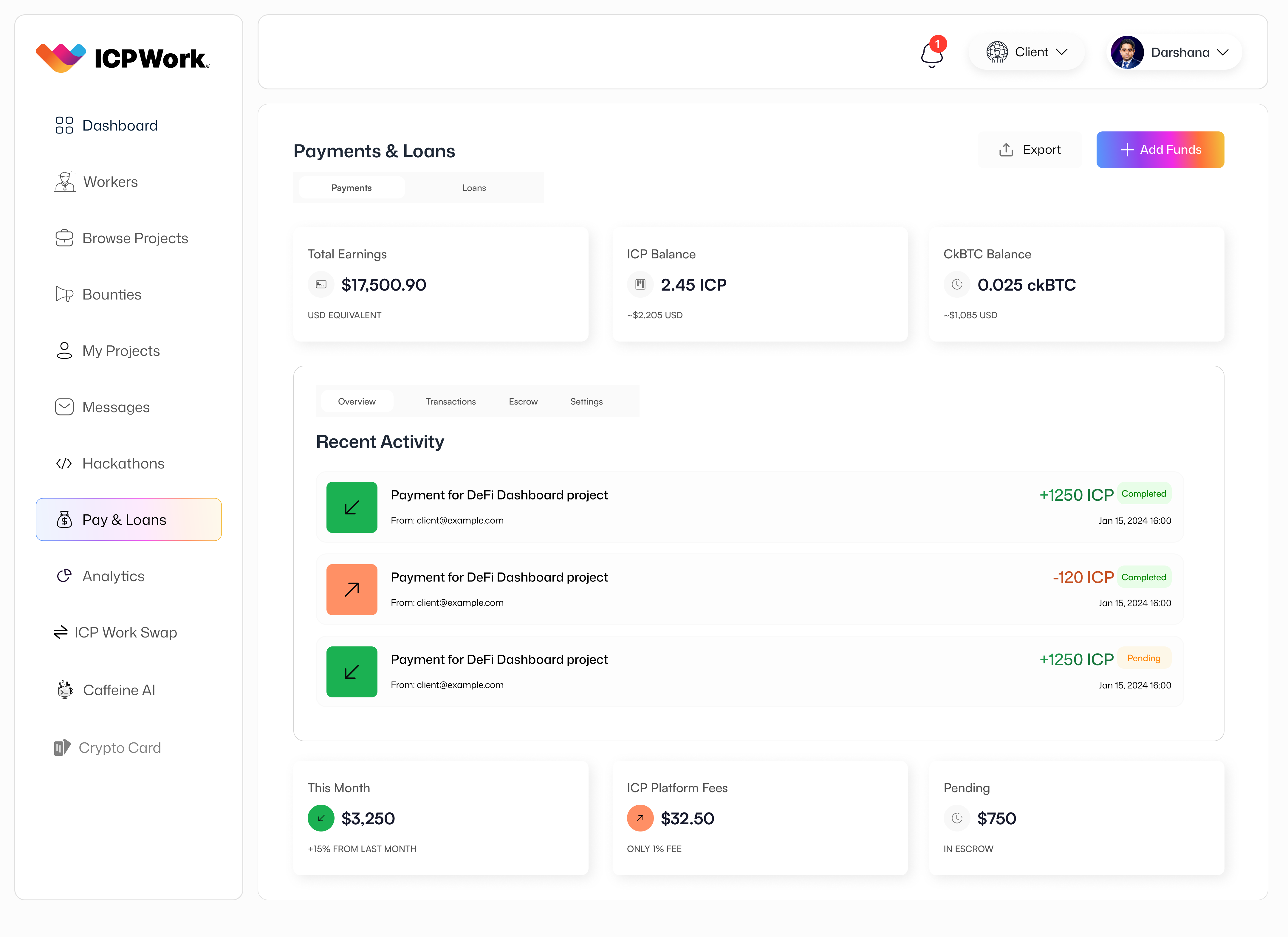

Payments & Loans

The Payments & Loans section of the ICPWork platform represents a significant expansion of its financial services, moving beyond basic escrow and payment processing to offer more comprehensive financial tools for freelancers and clients. This feature is designed to address the unique financial challenges faced by independent professionals, such as irregular income streams, limited access to traditional credit, and the need for quick liquidity. By leveraging the decentralized finance (DeFi) capabilities of the Internet Computer Protocol (ICP), ICPWork aims to provide accessible, transparent, and efficient financial solutions that empower its users.

Strategic Importance

The strategic importance of integrating Payments & Loans is profound. For freelancers, it offers financial stability and growth opportunities that are often unavailable through conventional banking systems. Access to micro-loans or advances against future earnings can help bridge income gaps, fund skill development, or invest in necessary equipment, thereby increasing their capacity and earning potential. For the platform, it enhances user loyalty and engagement by providing essential services that cater to the holistic needs of the freelancing community. This feature positions ICPWork not just as a marketplace for work, but as a full-fledged financial ecosystem for the decentralized workforce, further solidifying its value proposition and competitive edge in the Web3 space.

Key Features and Functionality

The Payments & Loans section is envisioned to include a range of financial services, all built on the principles of decentralization and transparency:

Decentralized Payment Processing

This core functionality ensures secure and efficient handling of all project-related payments. Leveraging smart contracts and the Payment Escrow Canister, funds are held securely and released automatically upon project completion or milestone achievement. This eliminates the need for traditional payment gateways, reducing fees and processing times.

Crypto Wallet Management

Users have access to an integrated, non-custodial crypto wallet that supports various cryptocurrencies, including ICP tokens and stablecoins. This allows for easy management of earnings, deposits, and withdrawals, all secured by the user's Internet Identity.

Micro-Loans for Freelancers

Freelancers can apply for small, short-term loans, potentially collateralized by their on-platform reputation, verifiable work history, or future earnings. These loans are facilitated through smart contracts, with transparent terms and automated repayment schedules. This provides crucial liquidity for freelancers facing unexpected expenses or seeking to invest in their business.

Earnings Advances

Similar to micro-loans, freelancers may be able to receive an advance on their pending earnings from active projects. This feature allows them to access funds before a project is fully completed, providing immediate liquidity while their work is still in progress.

Staking and Yield Opportunities

Users might have the option to stake their idle cryptocurrency holdings within the platform to earn yield, contributing to the platform's liquidity pools or supporting its operational mechanisms. This provides an additional avenue for passive income.

Financial Analytics and Reporting

Integration with the Analytics Dashboard provides users with detailed insights into their financial activities, including earnings trends, loan repayment schedules, and wallet balances. Comprehensive reporting helps users manage their finances effectively and for tax purposes.

Technical Implementation

The Payments & Loans section relies on a sophisticated architecture of interconnected ICP canisters:

- Payment Escrow Canister: Manages all project funds held in escrow and facilitates their release.

- User Wallet Canister: Handles the creation, management, and security of individual user cryptocurrency wallets.

- Lending Protocol Canister: A specialized canister that manages the logic for decentralized lending, including loan origination, collateral management (if applicable), interest rate calculations, and automated repayment.

- Liquidity Pool Canister: Manages the pools of capital that facilitate lending and potentially staking, ensuring sufficient funds are available for loan requests.

- Oracle Canister: Provides real-time price feeds for cryptocurrencies and other relevant financial data to ensure accurate loan valuations and conversions.

All these canisters operate on the ICP, ensuring high security, transparency, and censorship resistance. The use of smart contracts automates complex financial processes, reducing human error and increasing efficiency.

Conclusion

The Payments & Loans section is a transformative feature for the ICPWork platform, extending its utility far beyond a simple freelancing marketplace. By offering decentralized payment processing, integrated crypto wallet management, and innovative lending solutions, ICPWork is building a comprehensive financial ecosystem tailored to the needs of the modern freelancer. This commitment to financial empowerment, coupled with the robust and transparent infrastructure of the Internet Computer Protocol, positions ICPWork as a leader in the future of work, where financial freedom and opportunity are accessible to all.